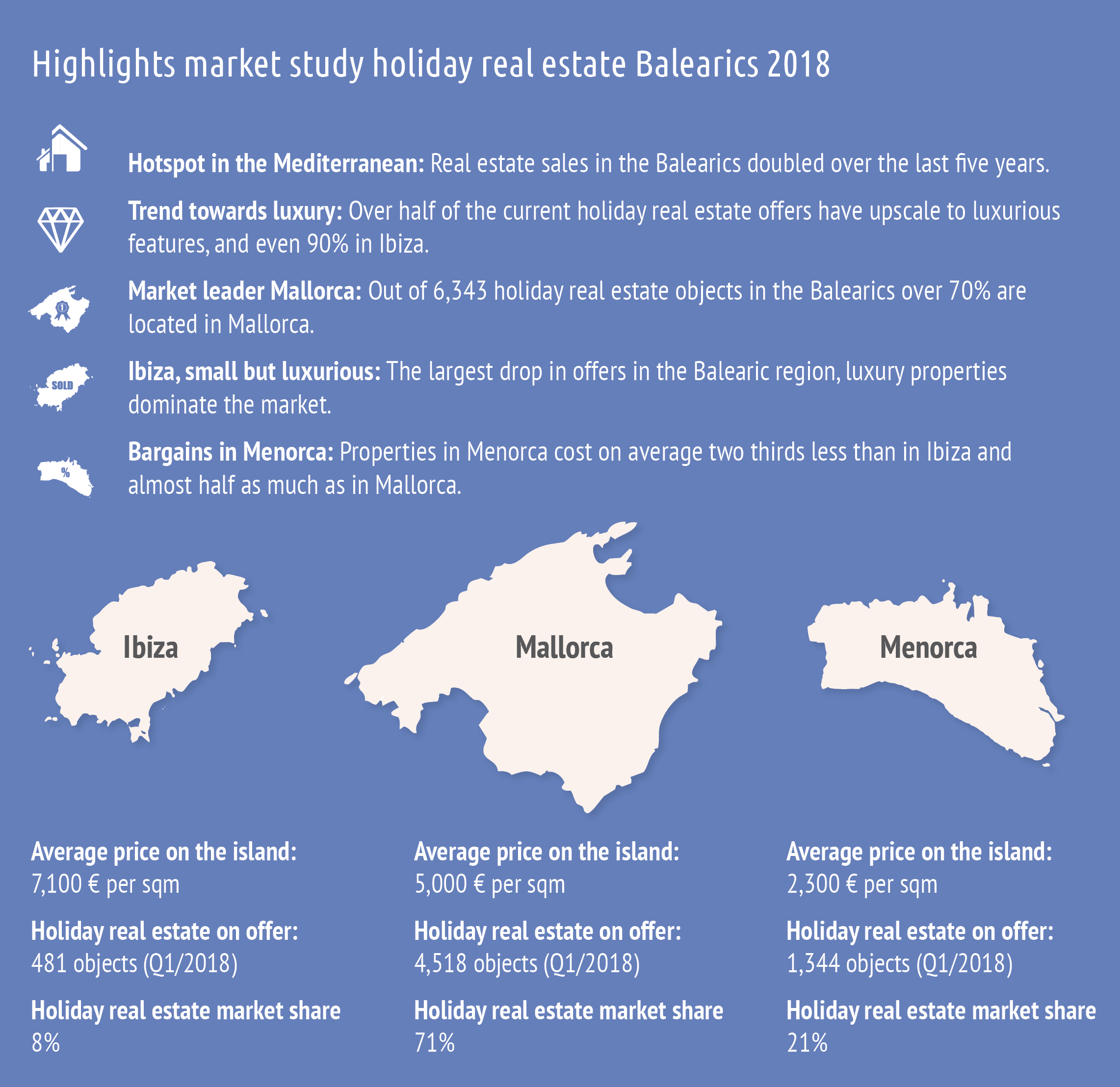

70% of the properties on offer are in Mallorca, Ibiza consists of 80% luxury offers and Menorca offers low entry prices.

Holiday properties in Mallorca, Ibiza and Menorca are very popular with foreign investors. More than one in three buyers does not live in Spain, and property transactions in the Balearic Islands have more than doubled in the last five years.

Sun, beach and sea. The Balearic Islands have plenty of everything to offer. How expensive the dream of owning your own property in Ibiza, Mallorca or Menorca will become has been determined in a market study.

In the first quarter of 2018, the STI Center for Real Estate Studies (CRES) was commissioned by Porta Mondial, a real estate agency specialised in holiday properties, to determine the holiday property market in the Balearic Islands by analysing over 6,500 online property offers from the largest brokers on the islands. The result is a representative image of the current market offer with a neutral price comparison list.

In the first quarter of 2018, the STI Center for Real Estate Studies (CRES) was commissioned by Porta Mondial, a real estate agency specialised in holiday properties, to determine the holiday property market in the Balearic Islands by analysing over 6,500 online property offers from the largest brokers on the islands. The result is a representative image of the current market offer with a neutral price comparison list.

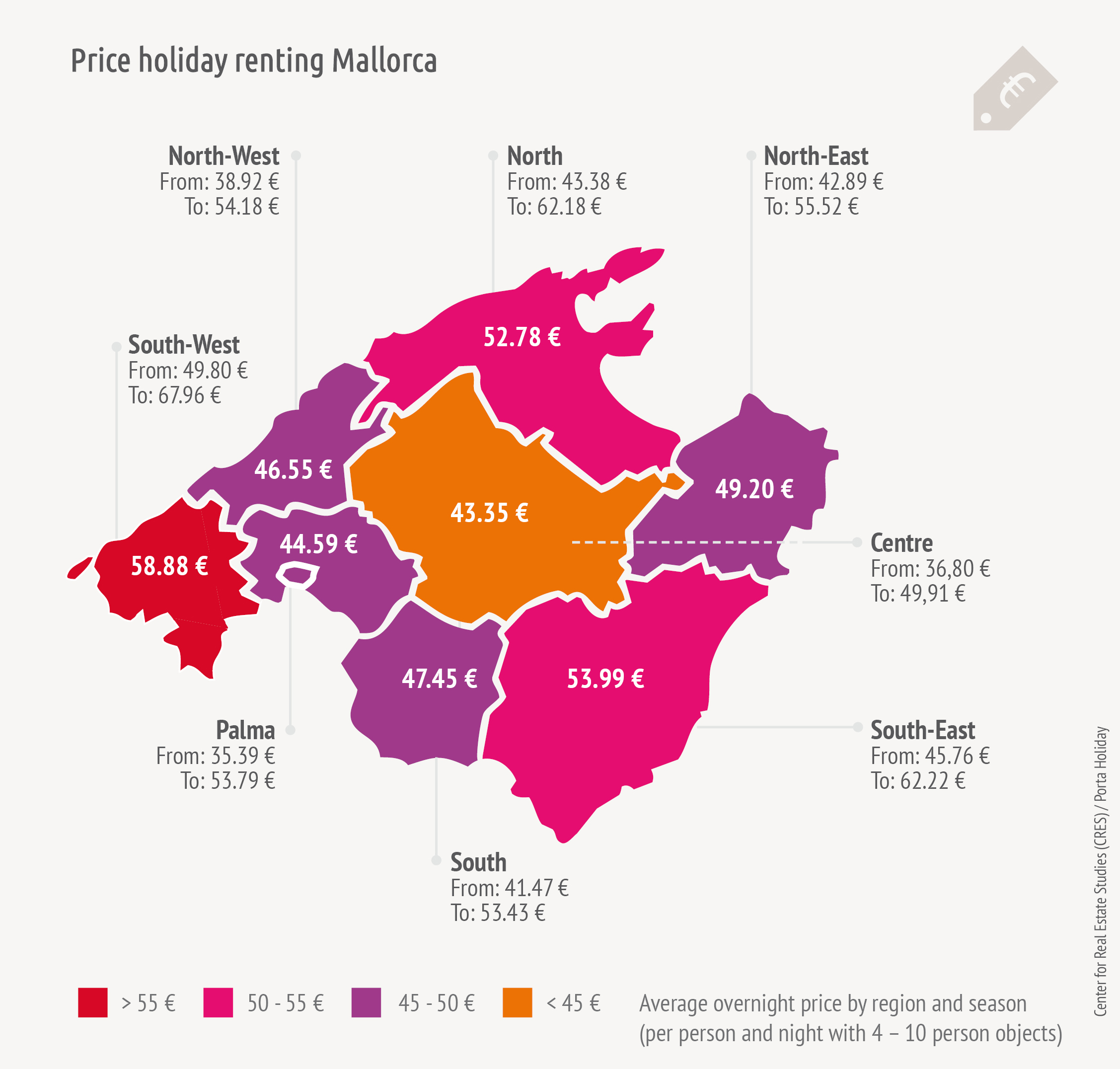

Mallorca dominates market supply

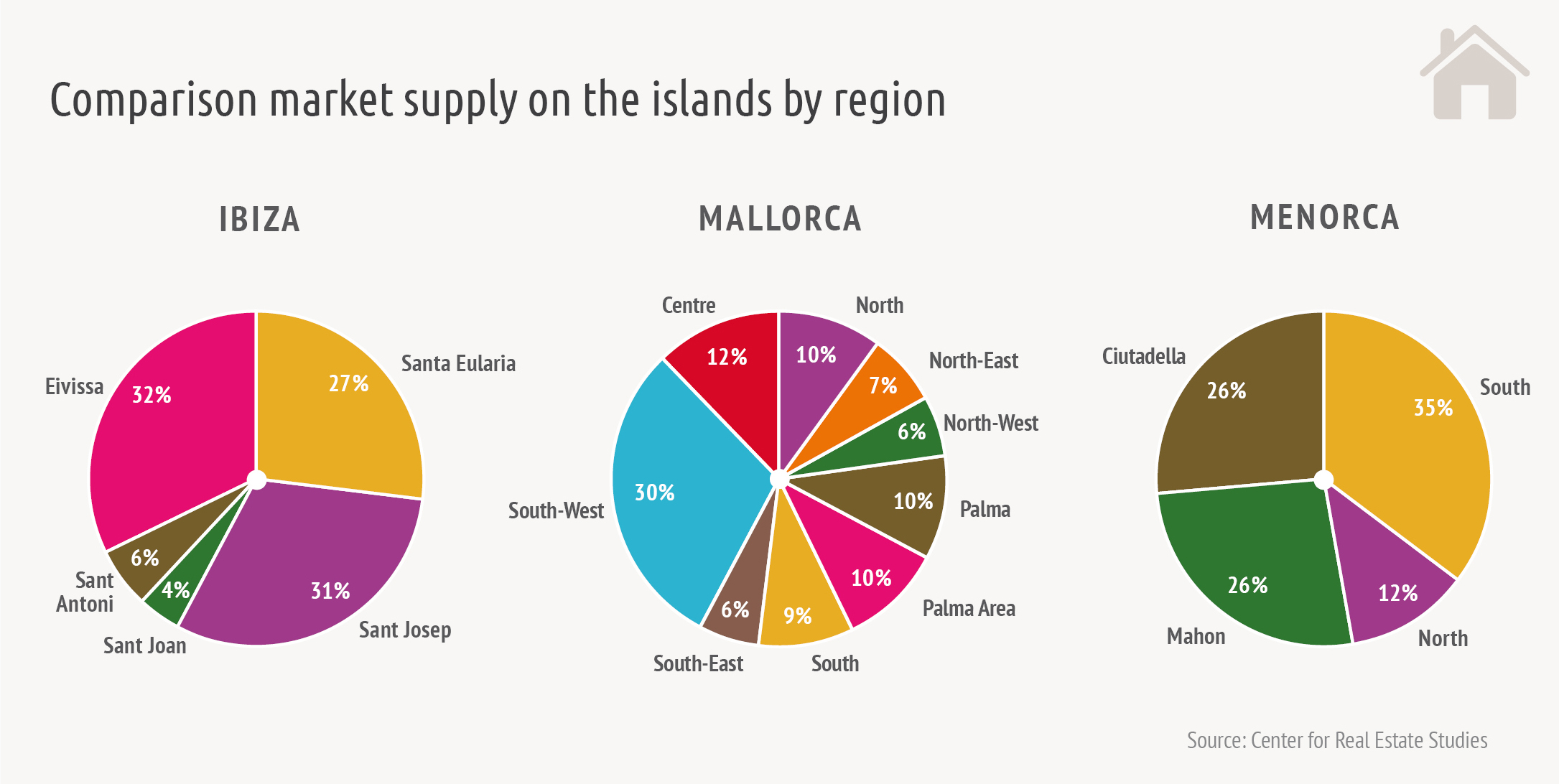

Investors find the richest selection of holiday properties in Mallorca. With over 6,300 properties, around 70% of the properties on offer are located on the largest Balearic island. One in five properties is located in Menorca, Ibiza has a small but fine market share of 8%.

The islands were divided into different regions for the market study. With a market share of 20% to 37%, the island capitals of Eivissa, Palma and Mahon with their surrounding areas offer a wide range of properties.

On all three islands, the relatively small supply of holiday homes in the northern parts of the island is striking. In Ibiza, the Sant Joan region accounts for only 4% of the offers, Mallorca’s north comprises 10% and Menorca, too, at 12% does not have many properties in the northern part.

Equipment: Every second holiday home is upscaled furnished

Ibiza is a luxury island in terms of furnishing criteria; around 80% of the properties on offer have upscale to luxurious furnishings. But on Mallorca the standard of equipment is also high. Almost half of the holiday properties on offer were classified as upscale or luxurious. If you are only looking for a simply furnished holiday home, you have less choice, only every tenth holiday home in Mallorca corresponds to this category. Menorca can be an alternative for these buyers. Here the ratio is practically reversed to Ibiza, only 10% of the offers fall under the category “luxury/upscale”:

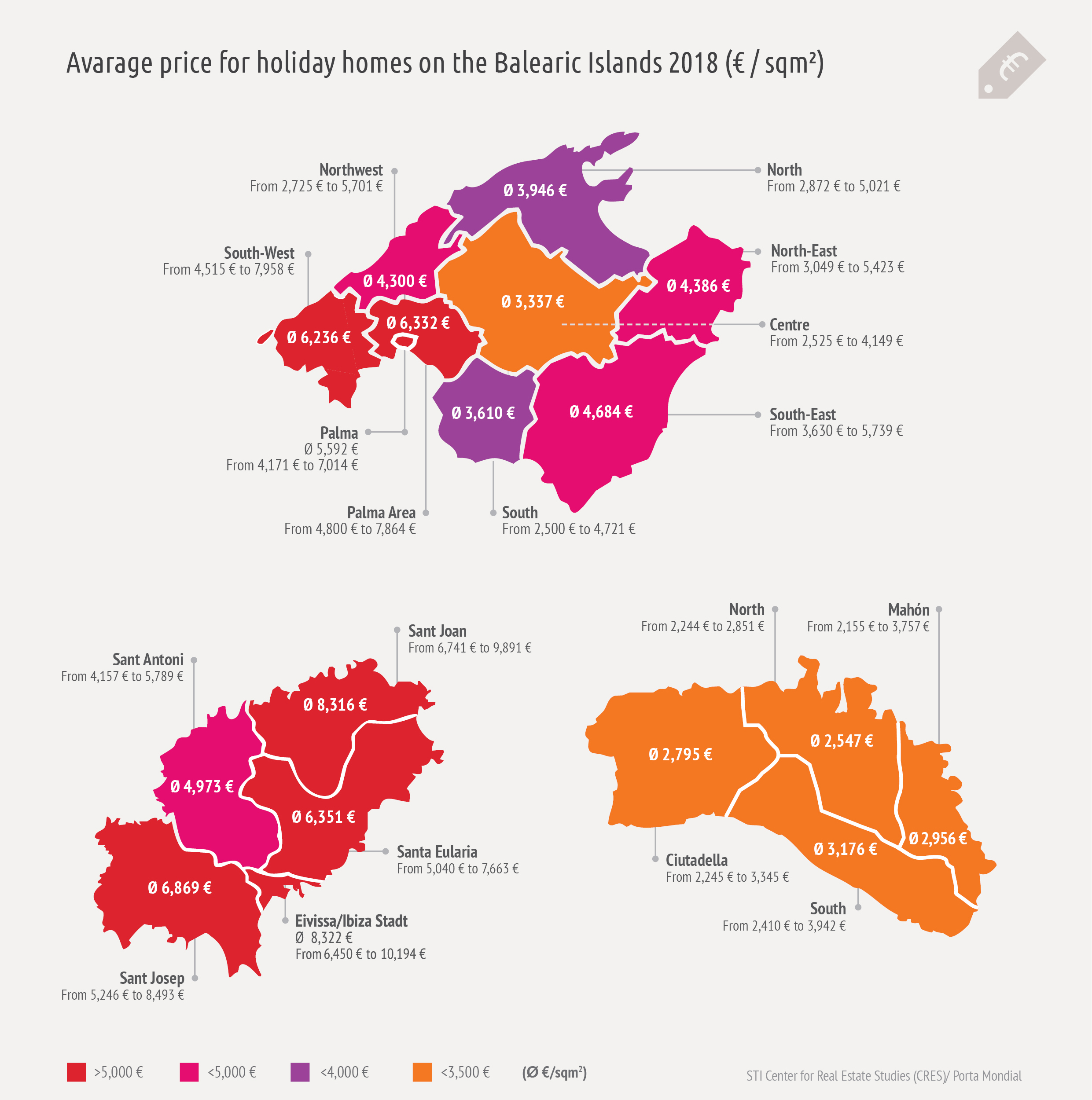

Price comparison: Ibiza is three times as expensive as Menorca

The high standard of equipment in the Balearic Islands is also reflected in the prices of holiday homes. Ibiza has prices per square metre that are only known on Mallorca in the high-price regions of the southwest and Palma. On Menorca, on the other hand, prices are relatively homogeneous across the island, roughly the same as in the cheaper regions of Mallorca.

Mallorca offers not only the widest range of products, but also the widest price ranges. Ibiza, with its many luxury properties, is about three times more expensive than Menorca, where simple to medium category holiday properties dominate the market.

Depending on location and how well the largerproperty is equipped, average prices range from €2,200 per square metre to over €8,300. The largest price range is covered in Mallorca, Ibiza is in the upper third due to the many luxury properties, while Menorca is in the lower price range due to more medium and simple properties.

Prof. Marco Woelfle, head of the study, states:

“As a rule of thumb, upper prices in Menorca roughly correspond to the entry prices in Ibiza”.

Front line to the sea justifies high price premiums

In addition to the warm climate, holiday properties in southern Europe offer a view that Berlin, London or Zurich are unfamiliar with – the sea. The coastal locations with views of the Mediterranean Sea are correspondingly sought after.

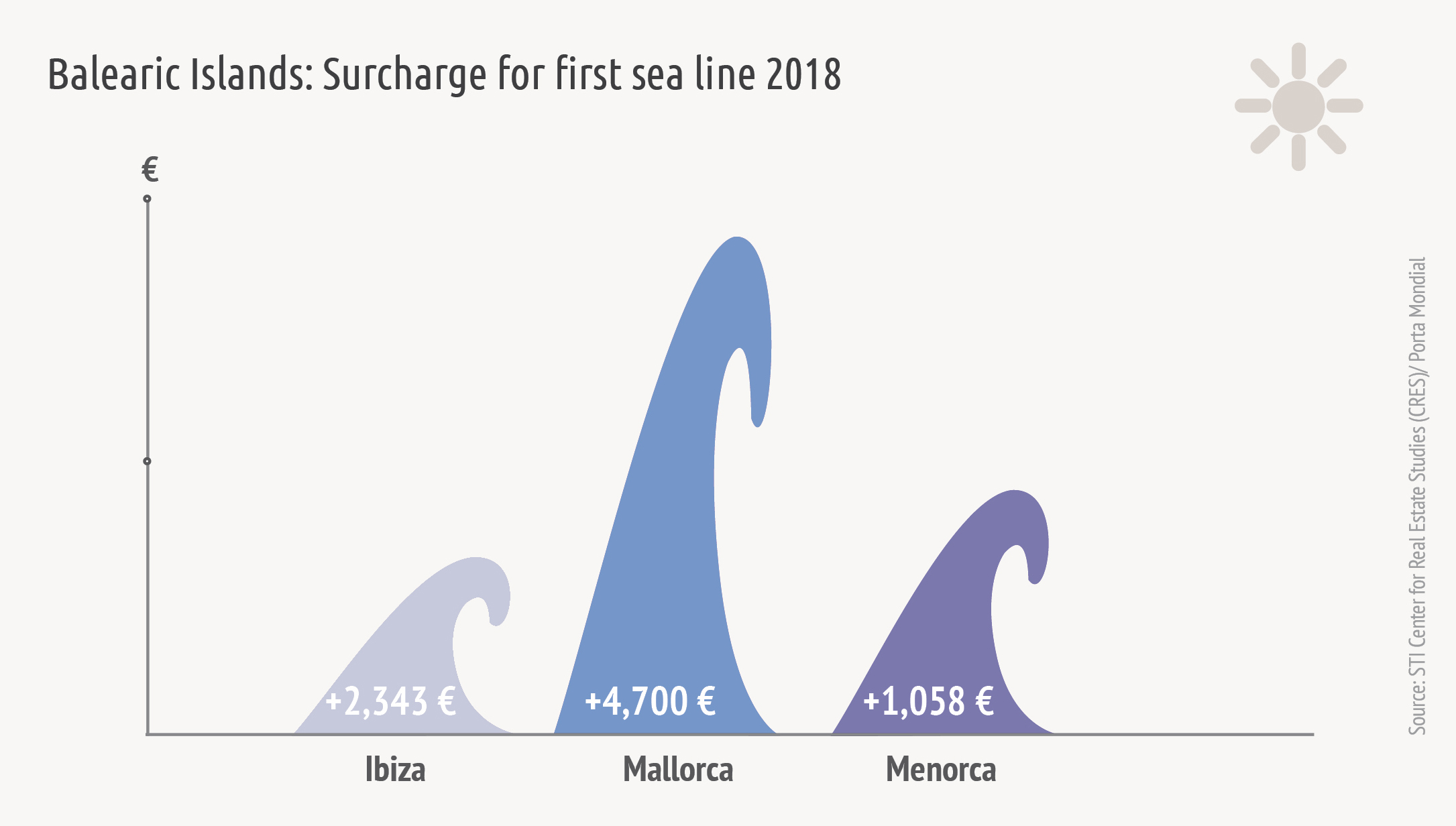

Together, the Balearic Islands have more than 1,100 km of coastline. In the present market study, CRES market researchers also analysed the price differences for the front line to the sea per island.

The more properties on offer, the higher the surcharges for the front line to the sea. In Mallorca, this can justify surcharges of up to 90%.

The highest surcharges for direct coastal or beach locations were determined with an average of 4,700 Euro/square metre on Mallorca. According to the study in Ibiza and Menorca this situation is not so important.

Prof. Woelfle explains this with the fact that:

“Most of Ibiza’s holiday properties are in a special location anyway and this has already been priced in in advance with the relatively high average level”.

Similarly to Menorca, many properties are concentrated in coastal locations and the front line is not as pricey as in Mallorca. There are many different locations on the largest Balearic island, from the lowlands in the centre of the island to the front line to the sea, which explains the relatively high price differences.

Overall, the holiday property market in the Balearic Islands is well mixed. While Ibiza may be less suitable for property investment due to the high price situation, Mallorca offers a wide selection. Menorca could be an alternative for those who are looking for a summer house on a Spanish island at moderate prices.

Porta Mondial’s Sales Manager for Spain, Thorsten Kaiser, can confirm this from his experience:

“Menorca is becoming increasingly attractive for foreign buyers. At the moment the French and British are very active here, but German customers are also increasingly discovering the island.”

He currently sees potential for value growth on all three islands:

“Demand in Mallorca remains high. At the moment we do not see any regional focus in property sales, the finca in the country is just as in demand as the old town apartment in Palma or a house directly by the sea. On Ibiza, demand is currently much higher than supply, and we expect prices to continue to rise here.”

Free Download

The market study holiday properties balearic islands 2018 is available for download free of charge here:

Marketstudy holiday real estate balearic islands 2018

Publication only permitted with reference to source “Center for Real Estate Studies/Porta Mondial”.

Highlights of the market study